Looking for used car financing options in Siloam Springs? Well, you’re not alone. Buying a car is one of the most significant financial decisions you’ll ever make, and finding the right financing option can feel overwhelming. Whether you’re a first-time buyer or just tired of public transport, this guide is here to help you navigate the maze of loans, deals, and everything in between.

Let’s face it, life moves fast, and having a reliable set of wheels is almost a necessity. But before you dive headfirst into the world of used car financing, it’s important to understand your options. From local lenders in Siloam Springs to online platforms, there’s more than one way to get that shiny ride you’ve been dreaming about.

This article will walk you through everything you need to know about used car financing options in Siloam Springs. We’ll break down the pros and cons, offer tips, and even throw in some insider secrets to help you make the best decision possible. So grab a coffee, sit back, and let’s get started!

Read also:Onlyfans Maestra Marleny The Rise Of A Digital Sensation

Why Used Car Financing in Siloam Springs Matters

First things first, why should you care about used car financing in Siloam Springs? Well, the answer lies in the numbers. According to recent data, the average cost of a used car in the U.S. is around $28,000. That’s a lot of dough, especially if you’re on a tight budget. But here’s the good news: financing makes it easier to spread that cost over time, so you can focus on other important expenses.

In Siloam Springs, where the cost of living might be slightly lower than bigger cities, used car financing options can be more flexible and tailored to your needs. Whether you’re looking for a compact car for daily commutes or a family-friendly SUV, the right financing plan can make all the difference. Plus, who doesn’t love saving money while still getting a great deal?

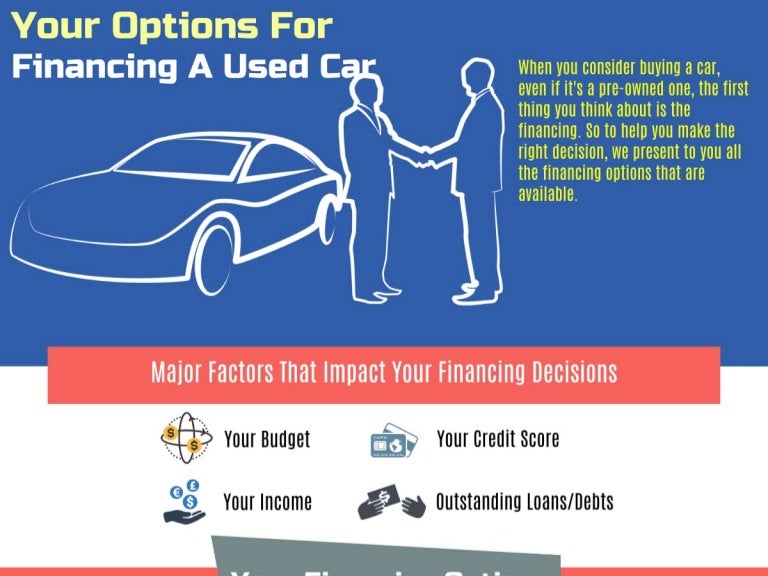

Understanding Your Financial Situation

Before we dive into the nitty-gritty of financing options, it’s crucial to take a step back and evaluate your financial situation. Ask yourself these questions: What’s your credit score? How much can you afford as a down payment? And most importantly, what’s your monthly budget? These factors will play a huge role in determining which financing option is right for you.

For example, if your credit score is on the lower side, don’t worry. There are still plenty of lenders in Siloam Springs who specialize in bad credit loans. On the flip side, if you’ve got a stellar credit history, you might qualify for lower interest rates and better terms. It’s all about knowing where you stand and making informed decisions.

Top Used Car Financing Options in Siloam Springs

Now that you’ve got a clearer picture of your financial situation, let’s explore the top used car financing options available in Siloam Springs. From traditional banks to online lenders, there’s something for everyone. Here’s a quick rundown:

- Local Banks and Credit Unions: These are often your best bet for competitive rates and personalized service. Many credit unions in Siloam Springs offer special deals for members, so it’s worth checking out.

- Online Lenders: If you prefer convenience, online lenders like LightStream or Ally Bank offer flexible terms and quick approvals. Plus, you can apply from the comfort of your couch!

- Dealership Financing: Some dealerships in Siloam Springs offer their own financing programs, which can be a great option if you’re buying directly from them. Just be sure to read the fine print.

- Peer-to-Peer Lending: Platforms like LendingClub connect borrowers with individual investors, offering a unique alternative to traditional loans.

Pros and Cons of Each Option

Every financing option comes with its own set of pros and cons. Let’s break it down:

Read also:Hailey And Aj Onlyfans The Ultimate Guide To Their Digital Empire

- Local Banks: Pros – competitive rates, personalized service. Cons – may require a higher credit score.

- Online Lenders: Pros – convenience, quick approvals. Cons – less personal interaction, potential hidden fees.

- Dealership Financing: Pros – easy application process, sometimes includes special promotions. Cons – higher interest rates, limited options.

- Peer-to-Peer Lending: Pros – flexible terms, potential for lower rates. Cons – less established, riskier for some borrowers.

How to Choose the Right Financing Plan

With so many options on the table, how do you decide which one is right for you? Here are a few tips to help you make the best choice:

1. Shop Around: Don’t settle for the first offer you see. Take the time to compare rates and terms from multiple lenders. Even a small difference in interest rate can add up over time.

2. Consider the Total Cost: It’s not just about the monthly payment; think about the total amount you’ll end up paying over the life of the loan. A lower monthly payment might seem attractive, but if the interest rate is high, it could cost you more in the long run.

3. Read the Fine Print: This one can’t be emphasized enough. Make sure you understand all the terms and conditions before signing on the dotted line. Look out for hidden fees, prepayment penalties, and other sneaky clauses.

Common Mistakes to Avoid

When it comes to used car financing, there are a few common mistakes that people often make. Here’s what to watch out for:

- Not Checking Your Credit Score: Your credit score plays a huge role in determining your interest rate. Before applying for a loan, make sure you know where you stand.

- Ignoring the Down Payment: Putting down a larger down payment can reduce your monthly payments and the total cost of the loan. Don’t skip this step!

- Going for the Longest Loan Term: While a longer loan term might mean lower monthly payments, it also means paying more interest over time. Stick to a term that fits your budget without stretching it too thin.

Used Car Financing for Bad Credit

Let’s talk about a topic that often gets overlooked: used car financing for bad credit. If you’ve had some financial setbacks in the past, don’t worry. There are still plenty of options available in Siloam Springs. Many lenders specialize in working with borrowers who have less-than-perfect credit scores.

Here are a few tips for getting approved with bad credit:

- Build Your Credit: Start by paying down existing debts and making all your payments on time. Even small improvements can make a big difference.

- Offer a Larger Down Payment: This shows lenders that you’re serious about the loan and reduces their risk.

- Find a Co-Signer: If possible, ask a trusted friend or family member to co-sign the loan with you. Just make sure they understand the risks involved.

Where to Find Bad Credit Lenders

There are several lenders in Siloam Springs that specialize in bad credit loans. Some popular options include:

- Capital One Auto Finance: Known for their flexible terms and competitive rates, even for borrowers with lower credit scores.

- CarMax Auto Finance: Offers a wide range of financing options, including bad credit loans, and has locations in nearby areas.

- DriveTime: A national chain that specializes in used car financing for people with bad credit. They have a location just a short drive from Siloam Springs.

Online Resources for Used Car Financing

In today’s digital age, there’s no shortage of online resources to help you with used car financing. From comparison tools to loan calculators, these platforms can save you time and money. Here are a few worth checking out:

- Edmunds: Offers detailed reviews, pricing information, and financing tips for used cars.

- Kelley Blue Book (KBB): A trusted source for vehicle valuations and financing advice.

- Bankrate: Provides loan calculators and comparisons to help you find the best rates.

Tips for Using Online Resources

While online resources can be incredibly helpful, it’s important to use them wisely. Here are a few tips:

- Verify Information: Double-check any data you find online with multiple sources to ensure accuracy.

- Use Loan Calculators: These tools can give you a rough estimate of your monthly payments and total cost.

- Read Reviews: Look for user reviews and ratings to gauge the reliability of a platform or lender.

Debunking Myths About Used Car Financing

There are plenty of myths floating around about used car financing, and it’s time to set the record straight. Here are a few common ones:

- Myth #1: Used Cars Are Always Cheaper: While used cars generally cost less than new ones, the total cost of ownership can vary depending on factors like maintenance and repairs.

- Myth #2: Bad Credit Means No Financing: As we’ve discussed, there are plenty of lenders who specialize in working with borrowers with bad credit.

- Myth #3: Longer Loan Terms Are Always Better: While longer terms might mean lower monthly payments, they also mean paying more interest over time.

Why Trust Matters in Used Car Financing

When it comes to used car financing, trust is key. Whether you’re working with a local lender or an online platform, it’s important to choose a provider you can trust. Look for companies with a strong reputation, transparent terms, and positive customer reviews.

Final Thoughts and Call to Action

Buying a used car doesn’t have to be a stressful experience. With the right financing options in Siloam Springs, you can find a plan that fits your budget and meets your needs. Remember to shop around, read the fine print, and don’t be afraid to ask questions.

So what are you waiting for? Start exploring your options today and take the first step toward owning your dream car. And don’t forget to share this article with your friends and family – who knows, they might be in the market for a new ride too!

Table of Contents

- Why Used Car Financing in Siloam Springs Matters

- Understanding Your Financial Situation

- Top Used Car Financing Options in Siloam Springs

- How to Choose the Right Financing Plan

- Used Car Financing for Bad Credit

- Online Resources for Used Car Financing

- Debunking Myths About Used Car Financing

- Why Trust Matters in Used Car Financing

- Final Thoughts and Call to Action