Let’s talk about Tesla's high P/E ratio because it’s got everyone buzzing in the financial world—and for good reason. Whether you're a die-hard Tesla fan or just someone trying to make sense of the stock market, understanding why Tesla’s P/E ratio is sky-high can feel like solving a complex puzzle. It’s not just about the numbers; it’s about the story behind them. Tesla isn’t your average company, and its valuation reflects that. But what exactly contributes to this astronomical figure? Stick around, and we'll break it down in a way that even your grandma could understand—or at least pretend to.

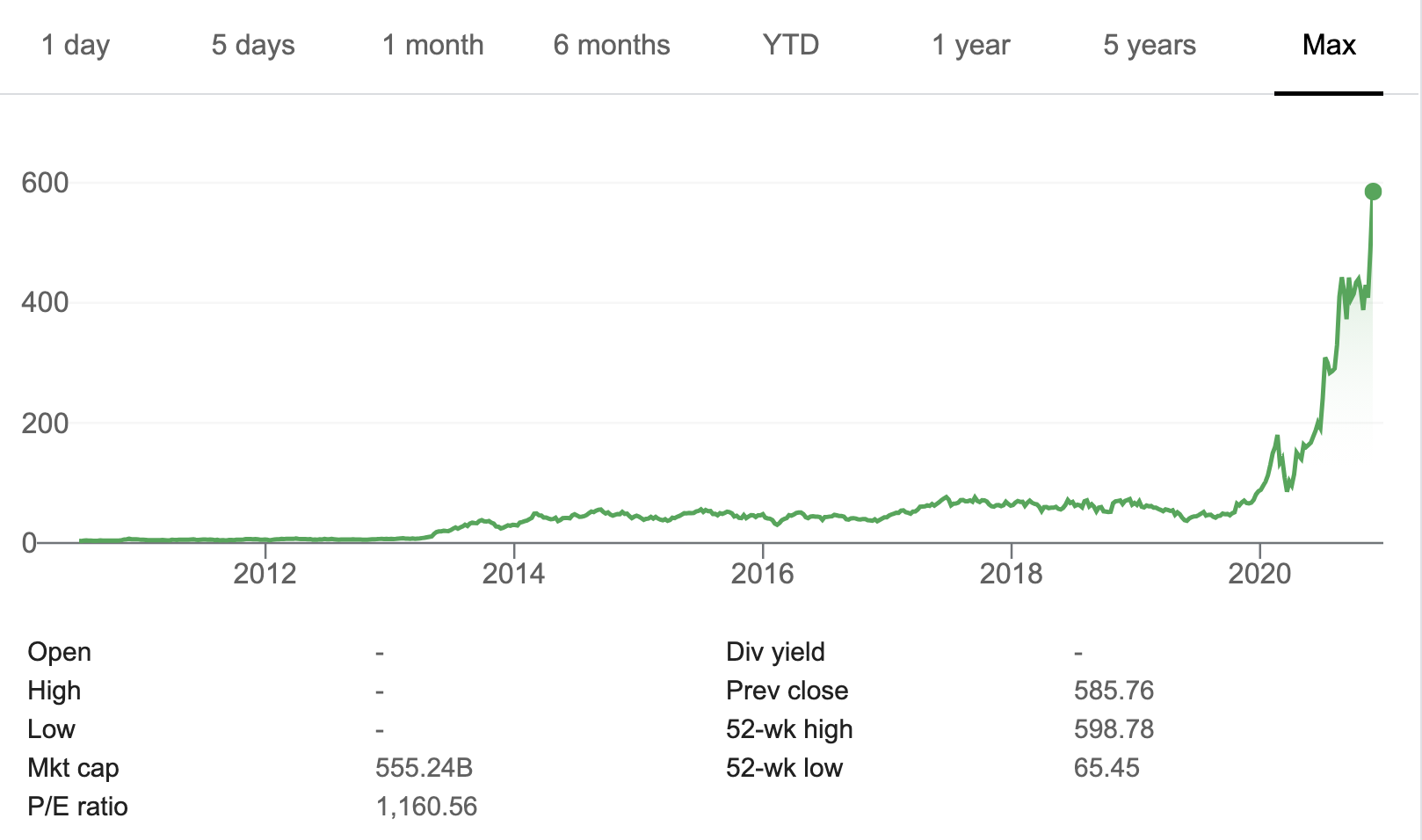

Tesla's P/E ratio has been a hot topic of debate among investors, analysts, and pretty much anyone who follows the stock market. For those who aren’t finance wizards, the P/E ratio is basically a way to measure how much investors are willing to pay for every dollar of a company’s earnings. In Tesla’s case, it’s through the roof, and that’s got people scratching their heads. Is it justified? Or is it just hype? Let’s find out.

Now, before we dive deep into the factors contributing to Tesla's high P/E ratio, let’s get one thing straight: this isn’t just about numbers. It’s about vision, innovation, and the future. Tesla isn’t just a car company; it’s a tech giant redefining industries. And that’s exactly why its valuation is so unique. So, buckle up because we’re about to take you on a ride through the factors driving this phenomenon.

Read also:Eevie Aspen Onlyfans Leaks The Truth Unveiled

Understanding Tesla's High P/E Ratio

Why P/E Ratio Matters

The P/E ratio, or Price-to-Earnings ratio, is like the stock market's report card. It tells you how much investors are willing to shell out for a company’s earnings. For Tesla, that number is huge, and it’s not because the company isn’t profitable—it’s because investors believe in its potential. Tesla’s high P/E ratio is a reflection of its growth trajectory, and that’s something worth exploring.

Think of it this way: when you buy a Tesla stock, you’re not just buying a piece of the company—you’re betting on its future. And let’s face it, Tesla’s future looks pretty bright. From electric vehicles to renewable energy, the company is at the forefront of some of the most exciting industries today. So, it’s no surprise that its P/E ratio is through the roof.

Key Factors Driving Tesla's P/E Ratio

Alright, let’s get into the nitty-gritty. What exactly contributes to Tesla's high P/E ratio? Here’s a breakdown of the key factors:

- Growth Potential: Tesla’s growth isn’t just impressive—it’s mind-blowing. The company has been expanding at a rate that most companies can only dream of. From launching new models to expanding into new markets, Tesla is showing no signs of slowing down.

- Innovation: Tesla isn’t just about cars; it’s about innovation. The company is constantly pushing boundaries with its technology, from battery advancements to autonomous driving. This level of innovation is rare, and it’s one of the reasons investors are willing to pay a premium.

- Market Leadership: Tesla is the undisputed leader in the electric vehicle space. Its dominance in the market gives it a significant advantage over competitors, and that’s reflected in its valuation.

The Role of Growth in Tesla's Valuation

Why Growth Matters

Growth is the name of the game when it comes to Tesla's high P/E ratio. The company has been growing at an exponential rate, and that’s what investors are betting on. When you look at Tesla’s growth trajectory, it’s easy to see why its P/E ratio is so high. The company is expanding into new markets, launching new products, and increasing its production capacity—all of which contribute to its valuation.

But it’s not just about the numbers. Tesla’s growth is also about its ability to disrupt industries. The company isn’t just selling cars; it’s revolutionizing the way we think about transportation and energy. That kind of growth potential is rare, and it’s one of the reasons investors are willing to pay a premium.

Expanding Into New Markets

Tesla’s expansion into new markets is another factor contributing to its high P/E ratio. The company isn’t just focused on the U.S. market; it’s expanding globally. From Europe to Asia, Tesla is making its presence felt in markets around the world. This global expansion is a key driver of its growth and valuation.

Read also:Asian Candy Of Leaks The Sweet Side Of Data Breaches

And let’s not forget about Tesla’s plans for the future. The company has ambitious goals, from increasing its production capacity to launching new products. These plans are all part of its growth strategy, and they’re reflected in its P/E ratio.

Innovation as a Key Driver

Why Innovation Matters

Innovation is at the heart of Tesla's high P/E ratio. The company is constantly pushing the boundaries of what’s possible, and that’s what sets it apart from its competitors. From its groundbreaking battery technology to its autonomous driving capabilities, Tesla is leading the charge in innovation.

But innovation isn’t just about cool gadgets; it’s about solving real-world problems. Tesla’s focus on renewable energy and sustainable transportation is a testament to its commitment to making a difference. This kind of innovation is rare, and it’s one of the reasons investors are willing to pay a premium.

Key Innovations Driving Tesla's Success

Here are some of the key innovations driving Tesla's success:

- Battery Technology: Tesla’s advancements in battery technology are changing the game. The company’s focus on reducing costs and increasing efficiency is a key driver of its success.

- Autonomous Driving: Tesla’s autonomous driving capabilities are pushing the boundaries of what’s possible. The company’s focus on safety and efficiency is a testament to its commitment to innovation.

Market Leadership and Competitive Advantage

Why Market Leadership Matters

Tesla’s market leadership is another factor contributing to its high P/E ratio. The company is the undisputed leader in the electric vehicle space, and that gives it a significant advantage over its competitors. Its dominance in the market is reflected in its valuation, and it’s one of the reasons investors are willing to pay a premium.

But market leadership isn’t just about being the biggest; it’s about being the best. Tesla’s focus on quality, innovation, and customer satisfaction sets it apart from its competitors. This kind of leadership is rare, and it’s one of the reasons investors are so bullish on the company.

Competitive Advantage

Tesla’s competitive advantage is another key driver of its high P/E ratio. The company’s focus on innovation, quality, and customer satisfaction gives it a significant edge over its competitors. Its ability to disrupt industries and redefine markets is a testament to its strength.

And let’s not forget about Tesla’s brand. The company has built a reputation for being at the forefront of innovation, and that’s something that’s hard to replicate. This kind of brand power is a key driver of its valuation.

Financial Performance and Earnings

Why Financial Performance Matters

Tesla’s financial performance is another factor contributing to its high P/E ratio. The company has been delivering strong earnings, and that’s reflected in its valuation. But it’s not just about the numbers; it’s about the trends. Tesla’s financial performance is showing signs of sustained growth, and that’s what investors are betting on.

And let’s not forget about Tesla’s ability to generate cash. The company has been increasing its cash reserves, and that’s a key driver of its valuation. Its ability to fund its growth and innovation is a testament to its strength.

Earnings Trends

Tesla’s earnings trends are another key driver of its high P/E ratio. The company has been delivering strong earnings growth, and that’s reflected in its valuation. But it’s not just about the numbers; it’s about the trends. Tesla’s earnings are showing signs of sustained growth, and that’s what investors are betting on.

And let’s not forget about Tesla’s ability to surprise. The company has a history of exceeding expectations, and that’s something that keeps investors coming back for more.

Investor Sentiment and Market Perception

Why Investor Sentiment Matters

Investor sentiment is another factor contributing to Tesla's high P/E ratio. The way investors perceive the company has a significant impact on its valuation. Tesla’s ability to inspire confidence and excitement among investors is a key driver of its success.

But investor sentiment isn’t just about hype; it’s about trust. Tesla has built a reputation for delivering on its promises, and that’s something that investors value. Its ability to inspire trust and confidence is a testament to its strength.

Market Perception

Market perception is another key driver of Tesla's high P/E ratio. The way the market views the company has a significant impact on its valuation. Tesla’s ability to inspire confidence and excitement among investors is a key driver of its success.

And let’s not forget about Tesla’s ability to surprise. The company has a history of exceeding expectations, and that’s something that keeps investors coming back for more.

Future Outlook and Growth Prospects

Why Future Outlook Matters

Tesla’s future outlook is another factor contributing to its high P/E ratio. The company has ambitious plans for the future, and that’s what investors are betting on. From increasing its production capacity to launching new products, Tesla’s growth prospects are looking bright.

But it’s not just about the plans; it’s about the execution. Tesla has a history of delivering on its promises, and that’s something that investors value. Its ability to execute its growth strategy is a testament to its strength.

Growth Prospects

Tesla’s growth prospects are another key driver of its high P/E ratio. The company has ambitious goals, from increasing its production capacity to launching new products. These plans are all part of its growth strategy, and they’re reflected in its valuation.

And let’s not forget about Tesla’s ability to innovate. The company’s focus on renewable energy and sustainable transportation is a testament to its commitment to making a difference. This kind of innovation is rare, and it’s one of the reasons investors are so bullish on the company.

Conclusion: Is Tesla's High P/E Ratio Justified?

So, is Tesla's high P/E ratio justified? The answer depends on how you look at it. For some, it’s a reflection of the company’s growth potential, innovation, and market leadership. For others, it’s a sign of overvaluation. But one thing is for sure: Tesla isn’t your average company, and its valuation reflects that.

As an investor, it’s important to do your homework and make informed decisions. Tesla’s high P/E ratio is a reflection of its unique position in the market, and that’s something worth considering. Whether you’re a believer or a skeptic, there’s no denying that Tesla is one of the most exciting companies in the world today.

So, what’s next? Leave a comment, share this article, or check out some of our other content. The choice is yours, but one thing’s for sure: Tesla’s story is just getting started.

Table of Contents