Ever wondered why the VIX is such a big deal in the financial world? Well, buckle up because we're diving deep into this topic. The VIX, short for the Volatility Index, has been dubbed the "fear gauge" by Wall Street wizards. But here's the kicker—it's not perfect. Yep, even this iconic market indicator has its own set of limitations that traders and investors need to be aware of. So, let's break it down and see what’s really going on.

Now, before we dive into the nitty-gritty, let’s set the stage. The VIX is essentially a measure of expected volatility in the S&P 500 index options market. It’s used by traders and investors to gauge the level of fear or complacency in the market. But here’s the thing—just like any other tool, it comes with its own set of quirks and limitations that can trip you up if you’re not careful.

In this article, we’ll explore the limitations of using the VIX as a market indicator. We’ll cover everything from its theoretical underpinnings to real-world applications. So, whether you're a seasoned trader or just starting out, this is the ultimate guide to understanding the VIX and its limitations.

Read also:Meg Turney Onlyfans Leaks The Real Scoop You Need To Know

Table of Contents

- What is the VIX?

- The Role of the VIX in Modern Markets

- Key Limitations of the VIX

- Long-Term Limitations

- Short-Term Limitations

- Data and Statistical Challenges

- Psychological Factors in VIX Interpretation

- Exploring Alternatives to the VIX

- Practical Applications of the VIX

- Final Thoughts

What is the VIX?

The VIX, or Volatility Index, is a measure of expected volatility in the S&P 500 index options market. It’s calculated by the Chicago Board Options Exchange (CBOE) and is often referred to as the "fear index" because it tends to spike when market conditions are uncertain. But here's the thing—while the VIX is a powerful tool, it’s not without its limitations.

Think of the VIX as a crystal ball that predicts market volatility. But, just like any crystal ball, it’s not always accurate. In fact, there are several factors that can affect its reliability. For instance, the VIX only measures implied volatility, which is based on expectations rather than actual market movements.

Let’s take a closer look at how the VIX is calculated. The index uses a formula that takes into account the prices of S&P 500 index options with different expiration dates. This gives traders and investors an idea of how volatile the market is expected to be over the next 30 days. But here’s the kicker—the VIX doesn’t tell you which direction the market will move, just how much it might move.

The Role of the VIX in Modern Markets

Now, let’s talk about why the VIX is so important in modern markets. Over the years, the VIX has become a go-to tool for traders and investors looking to gauge market sentiment. It’s used to hedge portfolios, make investment decisions, and even speculate on market movements.

But here’s the thing—while the VIX is widely used, it’s not always a reliable indicator of future market performance. In fact, there are several reasons why the VIX might not give you the full picture. For one, it only measures implied volatility, which is based on expectations rather than actual market movements.

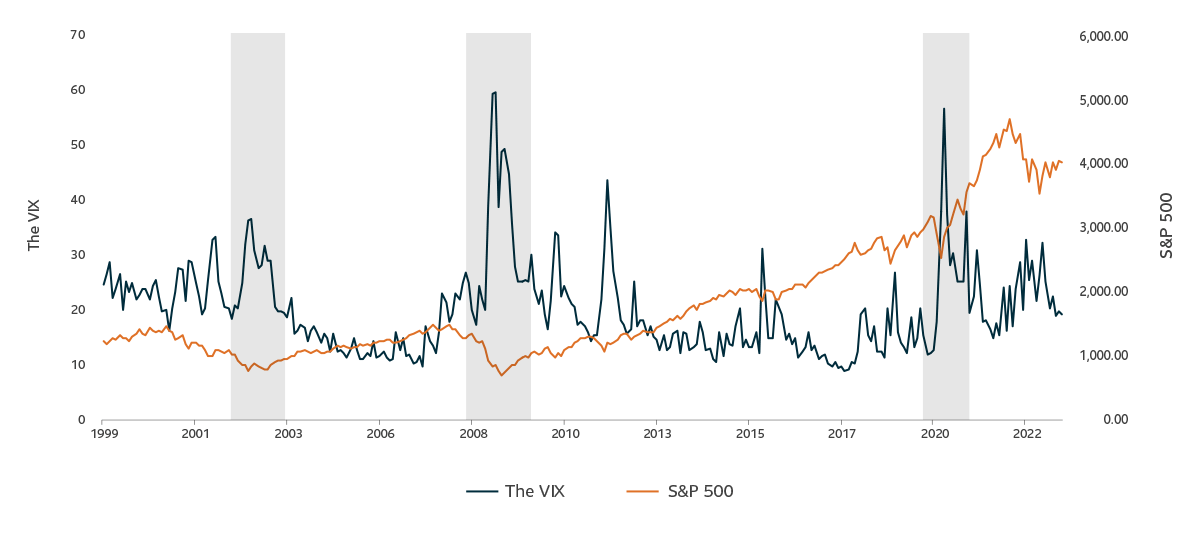

Another factor to consider is that the VIX is heavily influenced by short-term market events. This means that it can be volatile and unpredictable, making it difficult to use as a long-term indicator. So, while the VIX can be a useful tool, it’s important to understand its limitations before relying on it too heavily.

Read also:Jelly Bean Brains Leaked Onlyfans The Buzz The Facts And What You Need To Know

Why the VIX Matters

The VIX matters because it provides a snapshot of market sentiment. When the VIX is high, it indicates that investors are worried about the future. Conversely, when the VIX is low, it suggests that investors are feeling confident and complacent.

But here’s the thing—market sentiment can change quickly, and the VIX is no exception. In fact, the VIX can be influenced by a wide range of factors, including economic data, geopolitical events, and even social media trends. So, while the VIX can be a useful tool, it’s important to consider other factors when making investment decisions.

Key Limitations of the VIX

So, what are the limitations of using the VIX as a market indicator? Let’s break it down into a few key areas:

- Implied Volatility vs. Realized Volatility: The VIX measures implied volatility, which is based on expectations rather than actual market movements. This means that the VIX might not always reflect what’s actually happening in the market.

- Short-Term Focus: The VIX is heavily influenced by short-term market events, which can make it difficult to use as a long-term indicator.

- Limited Historical Data: The VIX has only been around since the 1990s, which means there’s limited historical data to analyze.

- Market Sentiment Bias: The VIX can be influenced by market sentiment, which can lead to inaccurate readings during periods of extreme fear or complacency.

These limitations mean that the VIX should be used as just one piece of the puzzle when making investment decisions. It’s important to consider other factors, such as economic data, company earnings, and global events, to get a more complete picture of the market.

Implied Volatility vs. Realized Volatility

One of the biggest limitations of the VIX is that it measures implied volatility rather than realized volatility. Implied volatility is based on expectations, while realized volatility is based on actual market movements. This means that the VIX might not always reflect what’s actually happening in the market.

For example, during periods of market calm, the VIX might be low, even if there’s significant underlying risk. Conversely, during periods of market turmoil, the VIX might spike, even if the actual market movements are relatively small. This discrepancy can make it difficult to use the VIX as a reliable indicator of future market performance.

Long-Term Limitations

When it comes to long-term investing, the VIX has several limitations that need to be considered. For one, the VIX is heavily influenced by short-term market events, which can make it difficult to use as a long-term indicator. Additionally, the VIX has only been around since the 1990s, which means there’s limited historical data to analyze.

Another factor to consider is that the VIX can be influenced by market sentiment, which can lead to inaccurate readings during periods of extreme fear or complacency. This means that the VIX might not always be a reliable indicator of long-term market trends.

Limited Historical Data

The VIX has only been around since the 1990s, which means there’s limited historical data to analyze. This can make it difficult to identify long-term trends or patterns in the market. Additionally, the VIX is heavily influenced by short-term market events, which can make it difficult to use as a long-term indicator.

Short-Term Limitations

On the flip side, the VIX can also have limitations when it comes to short-term trading. For one, the VIX is heavily influenced by short-term market events, which can make it difficult to use as a reliable indicator. Additionally, the VIX can be volatile and unpredictable, which can make it difficult to use in fast-moving markets.

Another factor to consider is that the VIX can be influenced by market sentiment, which can lead to inaccurate readings during periods of extreme fear or complacency. This means that the VIX might not always be a reliable indicator of short-term market movements.

Short-Term Volatility

The VIX can be volatile and unpredictable, which can make it difficult to use in fast-moving markets. For example, during periods of market turmoil, the VIX might spike, even if the actual market movements are relatively small. This can lead to inaccurate readings and make it difficult to use the VIX as a reliable indicator.

Data and Statistical Challenges

When it comes to using the VIX as a market indicator, there are several data and statistical challenges that need to be considered. For one, the VIX is calculated using a complex formula that takes into account the prices of S&P 500 index options with different expiration dates. This means that the VIX can be influenced by a wide range of factors, including economic data, geopolitical events, and even social media trends.

Another factor to consider is that the VIX can be influenced by market sentiment, which can lead to inaccurate readings during periods of extreme fear or complacency. This means that the VIX might not always be a reliable indicator of market performance.

Statistical Challenges

The VIX is calculated using a complex formula that takes into account the prices of S&P 500 index options with different expiration dates. This means that the VIX can be influenced by a wide range of factors, including economic data, geopolitical events, and even social media trends. As a result, the VIX might not always be a reliable indicator of market performance.

Psychological Factors in VIX Interpretation

Finally, let’s talk about the psychological factors that can influence how the VIX is interpreted. For one, the VIX is often referred to as the "fear gauge" because it tends to spike when market conditions are uncertain. This can lead to a self-fulfilling prophecy, where investors become more fearful and sell off their holdings, further driving up the VIX.

Another factor to consider is that the VIX can be influenced by market sentiment, which can lead to inaccurate readings during periods of extreme fear or complacency. This means that the VIX might not always be a reliable indicator of market performance.

Fear and Complacency

The VIX is often referred to as the "fear gauge" because it tends to spike when market conditions are uncertain. This can lead to a self-fulfilling prophecy, where investors become more fearful and sell off their holdings, further driving up the VIX. Conversely, during periods of market calm, the VIX might be low, even if there’s significant underlying risk.

Exploring Alternatives to the VIX

So, what are some alternatives to the VIX? While the VIX is a widely used market indicator, there are several other tools that can provide valuable insights into market volatility and sentiment. Some of these alternatives include:

- CBOE SKEW Index: The SKEW Index measures the perceived tail risk in the S&P 500 index options market.

- Put-Call Ratio: The put-call ratio measures the ratio of put options to call options traded on a particular stock or index.

- Historical Volatility: Historical volatility measures the actual volatility of a stock or index over a specific time period.

These alternatives can provide valuable insights into market volatility and sentiment, and can be used in conjunction with the VIX to get a more complete picture of the market.

Practical Applications of the VIX

Despite its limitations, the VIX can still be a valuable tool for traders and investors. Here are a few practical applications of the VIX:

- Hedging Portfolios: The VIX can be used to hedge portfolios against market volatility.

- Investment Decisions: The VIX can be used to make investment decisions based on market sentiment.

- Speculation: The VIX can be used to speculate on market movements.

By understanding the limitations of the VIX, traders and investors can use it more effectively as part of a broader investment strategy.

Final Thoughts

So, there you have it—the limitations of using the VIX as a market indicator. While the VIX is a powerful tool, it’s not without its quirks and limitations. From its focus on implied volatility to its susceptibility to market sentiment, there are several factors that can affect its reliability.

But here’s the thing—despite its limitations, the V